Thread and article. TL;DR...don't feel bad for hedge fund managers who got beat at their own game.

All of the sudden Juddle Gum wants the market to decide?

Wow this is a great week

Upvote

0

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Thread and article. TL;DR...don't feel bad for hedge fund managers who got beat at their own game.

Meanwhile dril hits way to close.to home... 10 years ago.

Thread and article. TL;DR...don't feel bad for hedge fund managers who got beat at their own game.

“Blue Horseshoe likes Anacott Steel.”Hedge funds literally are based on gaming markets with inside information and inside dealing to eventually leave a company like soiled, chopped up hooker in a field when the dust settles. The term vulture capitalism was first coined as a descriptor of their business model. Sorry that I'm not sorry to see this so viciously turned back on them by a bunch of rando, day traders on reddit.

My guess is that the vultures end up not taking much of a bath and that the reddit crowd ultimate does. Even without intervention. (Note: I don't care if I'm wrong, I have no love for the Wall St crowd but my guess is that when the dust settles, GameStop as a business is dead and the vultures are probably right).Hedge funds literally are based on gaming markets with inside information and inside dealing to eventually leave a company like soiled, chopped up hooker in a field when the dust settles. The term vulture capitalism was first coined as a descriptor of their business model. Sorry that I'm not sorry to see this so viciously turned back on them by a bunch of rando, day traders on reddit.

That's gold Jerryhttps://americancompass.org/the-commons/gamestop-intentionally-dying/

Good article here by Chris Arnade. His background is he spent years working on Wall Street. He brings some great insight and has the understanding and background to back it up.

I haven't followed this much today. Does anyone know if the hedge funds are even sitting on more shorts? I figure at least all their original ones are closed out at this point.

My guess is that the vultures end up not taking much of a bath and that the reddit crowd ultimate does. Even without intervention. (Note: I don't care if I'm wrong, I have no love for the Wall St crowd but my guess is that when the dust settles, GameStop as a business is dead and the vultures are probably right).

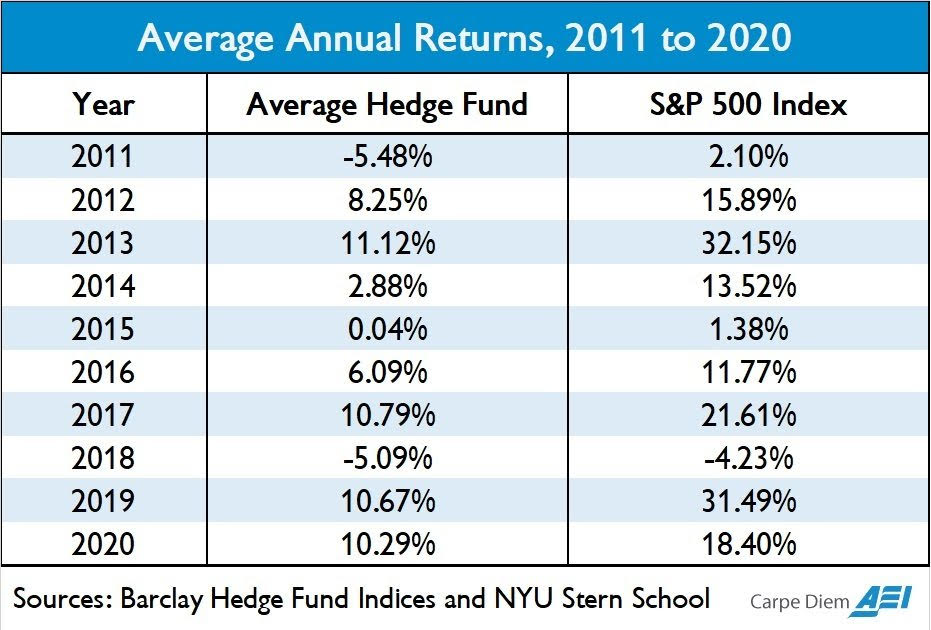

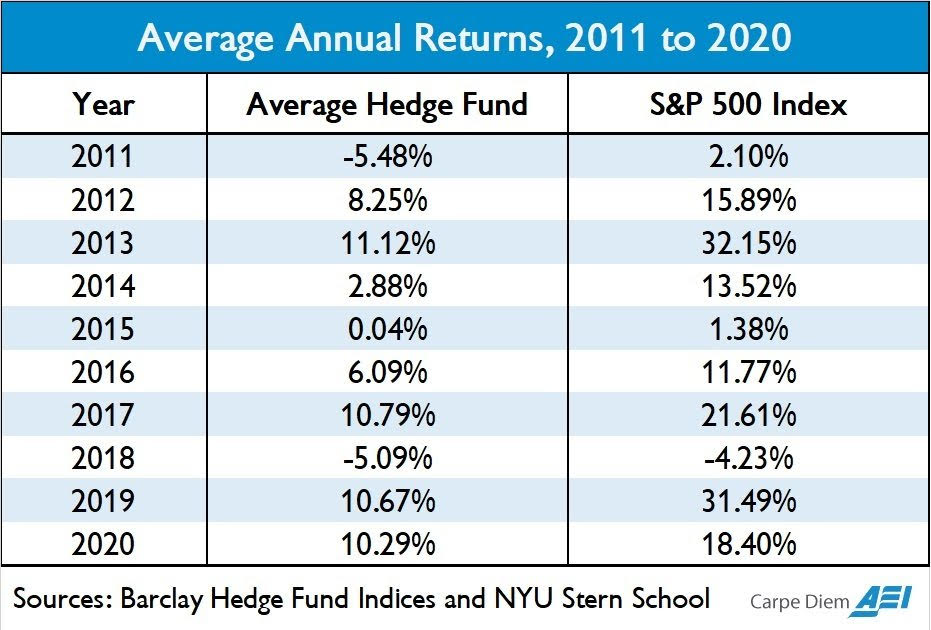

When my kids ask me why I won't let them put their money into hedge fund-like investments.